An interactive guide to financial wellness

Healthcare Professionals, this pathway was developed with you in mind!

Before getting started, download the Pathway to Prosperity guide to use alongside this blog.

Now let’s get right to it!

Financial Health is a critical part of your overall health. It is just as important as physical, mental and emotional health. If money problems start to get out of hand, it can most definitely have a negative impact on your overall well-being. In a February 2022 study from the American Psychological Association (APA), 65 percent of respondents said money is a significant source of stress. Money stress can cause you to lose sleep, increase anxiety, hurt your career, impact your family, and more.

Good news – stress related to money is something you can control and eliminate with a little knowledge and implementing a simple plan.

Taking control of your finances – achieving financial wellness – will set you on a positive path to living your best life!

What is Financial wellness?

Financial wellness is a state of being in which you have control over your financial decisions and feel confident in your ability to make choices that allow you to achieve your goals.

It’s knowing what you have, knowing where you’re headed, taking the steps to get there, and actually feeling good about it. It is defined as having enough to live comfortably and have the time to enjoy life.

In order to achieve financial wellness, you need a plan that works for you and be equipped with the right resources and knowledge to carry it out.

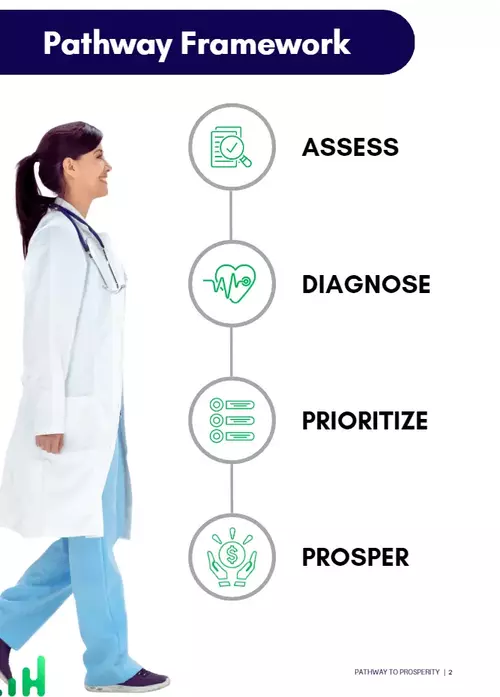

Pathway to Prosperity

At InvestHealth, our goal is to give every healthcare professional the network and knowledge needed to take ownership of their financial future.

We developed the PATHWAY TO PROSPERITY to serve as a guide on your journey to financial wellness. Let this be the kickstart you need to start feeling more confident with your money!

Part 1 - Assess

- What is your Why

- What are you Money Goals

- Examine your Money Mindset

Part 2 - Diagnose

- Know your Net Worth

- Calculate your Savings Rate

- Establish your Financial Independence Number

Part 3 - Prioritize

- Employer Match

- Debt Payoff

- Emergency Fund

- Invest

Part 4 - Prosper

- Automating your finances

- Your Investment Philosophy

- Automating your finances

ASSESS

If you work in healthcare, you know that the first step needed in helping a patient is an assessment. You need to gather information from patient history, learn about their medical complaints, and perform certain procedures. Assessing where you stand when it comes to financial wellness is essential because this gives you an idea of your motivations, money mindset and your financial goals.

Think of your WHY.

Defining your “why” is a key first step when it comes to being financially secure. It is the driving force that helps you become more consistent in taking actions to reach your financial goals.

Why do you want to be financially secure? Why is money important to you?

Exploring your life mission, beliefs and goals can help answer these important questions! Think of these things and how it relates to your:

Family

Education

Retirement

Freedom

Possessions

Experiences

Travel

Health

Ultimately, finding out your WHY helps you discover your fundamental values. These values are expressed through financial decisions and when your decisions align with your values, you get a very real sense of satisfaction and contentment; which ultimately is what we all strive for in this life.

Set yourMONEY GOALS

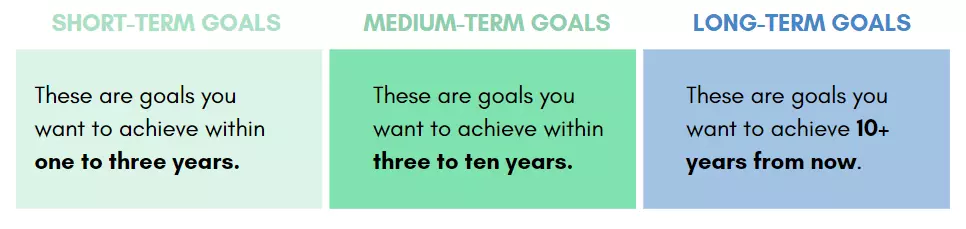

As author Bob Moawad preaches, when you set exciting, worthwhile goals for yourself, you will work on them, they also work on you.

Financial goals that get you to the root of your values gives you CLARITY and helps you focus on what’s important to you and keep you from making financial decisions that derail you from those goals. MONEY is a tool and a powerful one that you can use to help you design a life around what’s most meaningful to you.

How do you see your dream life? For most people it’s hard to articulate that vision. I can attest to this, because when I was a new grad nurse, I never thought of retirement. It’s hard to think about the future when there are so many things affecting how you are at present. You may still be paying off your student loans or you have children that are about to go to school.

However, having a framework of where you want to be in life -will help you create actions that lead to that dream life. Solidify your financial goals so you can create a personal, lifelong plan to guide all of your investing and spending decisions.

Now, let’s talk aboutMoney Mindset

The way we view money is shaped by our experiences, upbringing and society. Many of our core beliefs about money, whether conscious or not, are formed in early childhood by observing how our parents, family and friends deal with their finances. Also, by internalizing money messages that we deal with in our daily lives.

This relationship we have with money is what leads to what we know as our “money mindset”. Money Mindset is a combination of empowering AND limiting beliefs we have about money. It defines how you think about money and influences how you spend, how you save , how you utilize debt, and how you manage your finances. This is unique to YOU.

“Whether you think you can or think you can’t. You’re right” – Henry Ford

Money mindset allows you to make the choices that align with the financial goals that you have set. It helps you create new healthy habits and break old ones.

NextSTEP

Now that you have set a good mental foundation when it comes to managing your finances- it’s time to get knowledgeable with money.

Tell me a time when your employer sat you down to talk about your retirement goals & paying off student loans. What class did you take in high school on the stock market? Did anyone teach you about credit scores and interest rates?

Most of us don’t have the basic financial knowledge because this is something that was never taught in school nor taught by our parents. Maybe we also did not have a good relationship with money or a positive money mindset. Either way, most of the causes of financial stress is due to lack of financial education.

I was making a decent salary when I started working as a nurse, yet I found myself still living paycheck to paycheck. This is very true for most people in our country alone, because according to an S&P survey, only 57% of adults in the US are financially literate.

Throughout the remainder of this guide, you will encounter terms that you may or may have heard before. Let’s learn them together and diagnose our current financial health!

DIAGNOSE

Know your Numbers!

What is yourNet Worth?

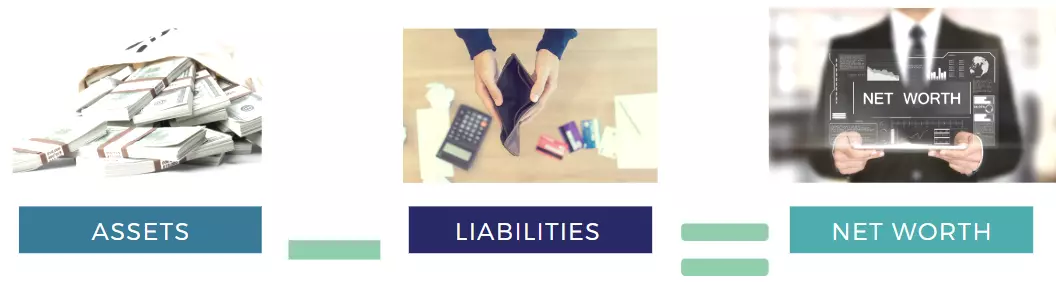

What exactly is “net worth” and why is this important to know as a healthcare professional?

First, let’s figure out how it is calculated:

Assets (what you own) – Liabilities (what you owe) = your Net Worth

It is basically the total value of everything that you own:

- House

- Businesses

- Cars

- Investments Such As Stocks And Bonds

- Cash In Your Bank Accounts

Then you subtract your liabilities, or total debts that you owe, such as:

- Mortgages

- Car Loans

- Student Loans

- Credit Card Debt

- Personal Loans

Notice how there is no mention of your income. Even if you earn a million dollars then spend all on coffee and scrubs, you will have a net worth of zero.

Your net worth is determined by how much money you keep, not how much money you make.

Knowing this number is important because just like everything in life, if you want to improve on something you have to keep track of it. Think of all the charting and tracking we do as healthcare professionals. For example, when caring for patients in the hospital we look at their intake and output, lab values, vital signs, and more! We monitor these numbers to see if their conditions are improving.

Your net worth shows your financial progress just the same way. Tracking it will help you determine if there’s some changes you have to make when it comes to managing your finances. When it comes to retirement, once your invested assets reach a certain number, you are financially free! Knowing and tracking these numbers can also provide motivation and help you work towards your financial goals.

What is yourSavings Rate?

How much are you saving or investing each month? What percentage of your income are you “putting aside” for your financial goals, emergency funds or retirement? This is what you call SAVINGS RATE.

Most financial professionals recommend around 15%, but pair this with your goals and see if you should increase or decrease that amount. The higher your savings rate, the faster you will reach your financial goals and financial independence!

What is yourFinancial Independence Number?

You might have heard of the acronym FIRE which stands for Financial Independence, Retire Early. It’s a growing movement of people who are choosing to live the life they want to live by achieving financial independence and retiring earlier than the typical age of 60.

Retirement is a topic that might’ve crossed your mind since you started your job in healthcare. Your idea of retirement is probably different from your colleagues.

The nurse you work with who plans on traveling the world won’t have the same monetary needs or goals during retirement as the pharmacy tech who’s planning on having a quiet retirement with grandchildren and gardening.

Every person’s needs in retirement are different because retirement is NOT a one size fits all plan. With that said, calculating your FI (Financial Independence) NUMBER and knowing how to invest to reach that goal is an extremely beneficial exercise.

In order to calculate your FI number, take your average yearly expenses (mortgage, rent, groceries, subscriptions, entertainment, etc) and multiply by 25. This calculation is a rule of thumb that is accepted in most financial circles. It is based on the “4% rule” and the Trinity Study.

This number is what you need invested so you can “safely” retire.

After calculating your FI number, this number may seem high and out of reach, but don’t be discouraged! By increasing your savings/investing rate, starting a side hustle, investing in real estate, etc.. you can get there quicker than you think!

PRIORITIZE

Now that we have assessed and diagnosed your current financial picture, let’s prioritize what’s most important!

Complete the SWOT analysis on your download to get an idea of your Strengths, Weaknesses, Opportunities, and Threats.

EmployerMatch

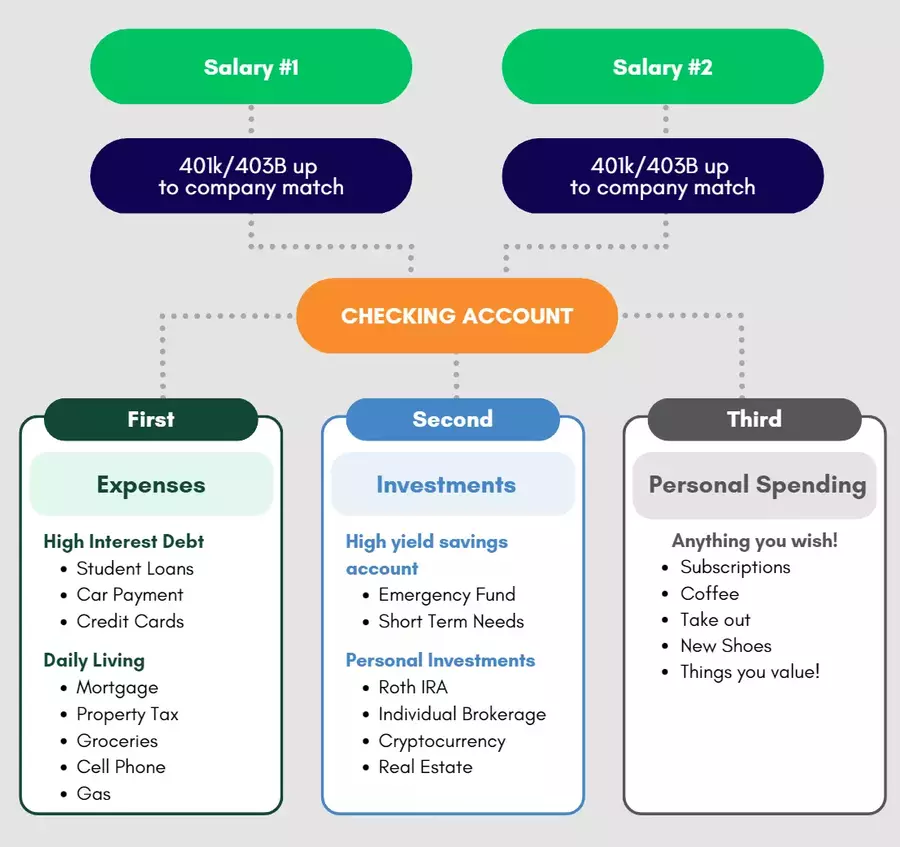

Top priority is making sure you are getting your employer match! Financial Engines (2015) estimates that workers leave $24 billion unsaved by not fully matching their employer contribution.

Most employers match, in whole or in part, a percentage of contributions to such accounts, while others match contributions up to a given dollar amount.

For example, if your employer pledges to match 5% of your income per pay period, you should be allocating AT LEAST 5% of your income towards the retirement plan (or more, if you can). This is free money!

Check with your HR department today if you are unsure how to access your retirement account and adjust your contribution accordingly.

EmergencyFund

Bankrate found that 60% of Americans were unable to pay an unexpected $1,000 expense. It also revealed that 77% of survey respondents said that either themselves or an immediate family member had to deal with a financial emergency in the last year that was $1,000 or more.

Uncertainties are a given and financial emergencies are inevitable, but with a solid emergency fund in place, you’ll be able to handle these situations with ease.

A general rule of thumb is to have 3-6 months of your living expenses stored in an emergency fund.

Having an emergency fund established is essential because it ensures that you have some cushion in place to help mitigate negative impacts on your budget, financial plans, and goals.

This emergency account should be separate from your checking account and your general savings account. This helps to reduce temptation to access it for something other than an emergency. A High Yield Savings Account (HYSA) is an excellent place to store your emergency fund. We recommend Ally for its ease of use and ability to create customized savings “buckets”.

This emergency account should be separate from your checking account and your general savings account. This helps to reduce temptation to access it for something other than an emergency. A High Yield Savings Account (HYSA) is an excellent place to store your emergency fund. We recommend Ally for its ease of use and ability to create customized savings “buckets”.

Debt Payoff

Next priority is to pay off all high interest debt!

Getting out of debt takes a lot of work and dedication, especially if you’re trying to pay off debt with massive student loans and credit card bills.

Dealing with multiple debts at once can be a daunting task, especially considering the competing needs to invest toward other financial goals. But it shouldn’t be like that. You just need to have determination and the right plan to help you on this journey to eliminate debt.

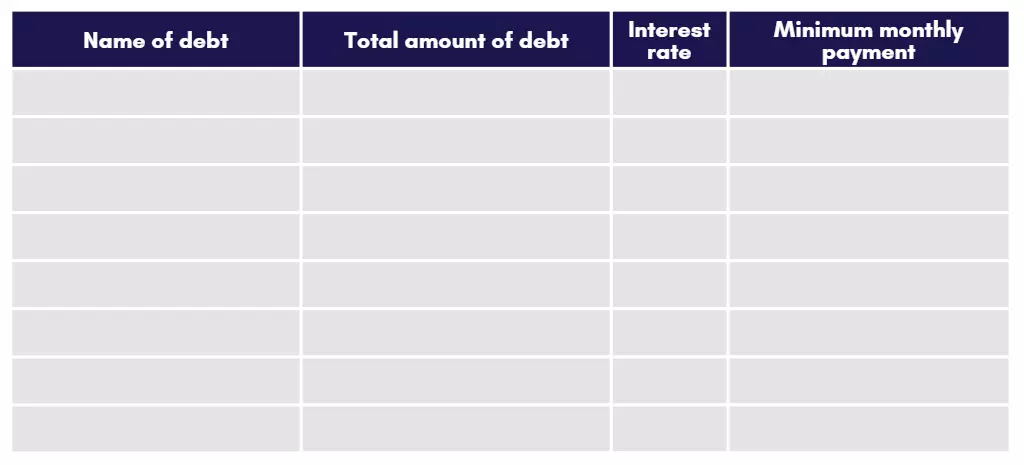

Start with a simple table and list out all the details of your debts, then choose a method on how to best pay it off.

Snowball vs Avalanche Method

In the snowball method, you pay off your debts with the lowest balance first.

In the avalanche method, you pay off the debt with the highest interest rates first.

Stay committed and prioritize paying this off and you will find yourself in a better financial situation and well on your way to reaching your financial goals!

Invest

- Employer Match

- Emergency Fund

- Debt Payoff

- Optimize Investments

Investing is a very intimidating topic to talk about. Most of us are under the impression that investing is very risky and we will just lose money in the process. However, if you’re armed with the right resources and knowledge about investing- you can do it with minimal risk.

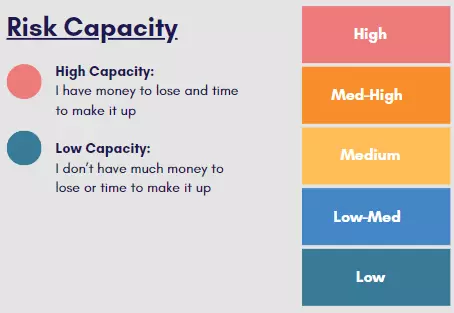

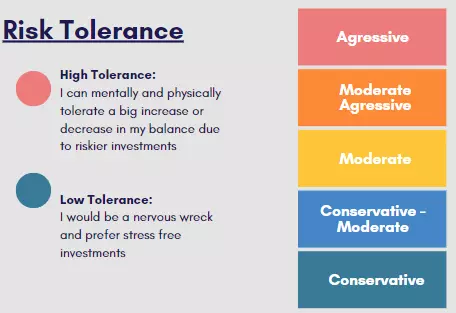

Knowing your risk capacity and risk tolerance is key to successful investing.

Determining your risk capacity and risk tolerance is based on a number of factors such as your age, amount of money you currently have, amount of time you have until your desired retirement age, how active or passive you want to be in your investments, and more. Where do you stand?

As healthcare workers, we work so hard for our money. Investing allows us to make our money work for us!

When you make an investment, you let it grow by what we call “compound interest” . It’s basically interest on interest. You gain interest on your principal + the interest it accrued. It helps to explain why investing money over a long term horizon is extremely powerful due to the fact that your wealth can grow more quickly from earning money on the earned money.

You might be asking, “But I invest in my company’s retirement account, is that sufficient?” The answer to this question depends on many factors, such as your goals, current net worth, and more. Educate yourself on the basics, then work with one of our trusted financial planners to learn what will work best for you!

On a very basic level, you pick a company, open the account that is right for you, then invest in a fund inside that account!

An easy way to get started is to open a regular, individual account with the brokerage of your choice, say Sofi.

Once you open a regular account with Sofi, link your bank account, move money into Sofi, you can then buy a fund, say VTI.

VTI is an ETF (Exchange Traded Fund) that has stocks inside of it from the entire stock market. It’s like a bucket that holds all the stocks of the stock market! This is one of the most recommended, low risk, moderate reward funds out there!

Some will do great, some stocks not so great. This is a low risk, conservative investment, and something to consider as a great way to get started and learn.

We will do deep dives on the Individual, Roth IRA, Health Savings Account, Traditional IRA, and more in following blogs!

PROSPER

We have now assessed our financial standing, diagnosed our financial health and prioritized critical money interventions… let’s put a few more practices in place and PROSPER!

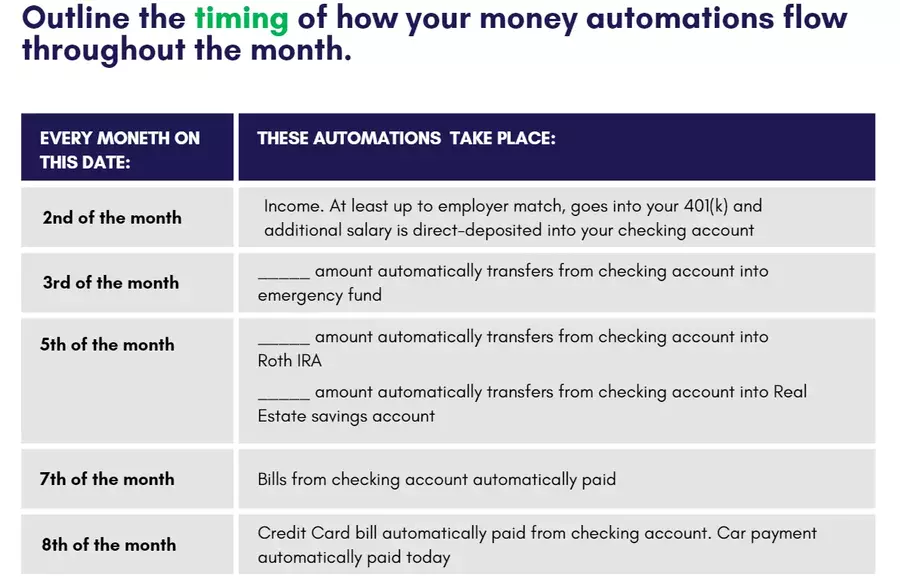

Automatingyour finances

The reason why it’s so powerful is because it takes willpower, weekly monitoring, and uncertainty out of the equation. Having a “set it and forget it” system in place for your finances can truly help you prosper.

Knowing exactly where your money is going, and when, will be one of the best things you can do in your personal finance journey.

The Pathway to Prosperity download has excellent outlines and templates for you to organize this money flow. Take some time to organize and outline your automation process now!

Create yourInvestment Philosophy

Now that you have made it this far, you have a much clearer understanding of your financial picture. Your Investment Philosophy should serve as your guide for the investment decisions you make going forward. Don’t try to get this perfect right now, as it will evolve as you learn more and become more comfortable with your personal finances.

SideHustles

A great way to prosper financially is starting a “side-hustle”. Doing this can accelerate wealth building and allow you to reach your financial goals sooner! Not to mention, it can be exciting, challenging, and help other people along the way. All while maintaining your full time job!

The average millionaire has multiple income streams! Your job and investments are a couple income streams. Add to that with a side hustle.

Having multiple streams of income allows for diversification and provides a level of financial security that most people don’t have. If one stream of income dries up, you still have others to fall back on!

Here are a few ideas to consider:

Beyondthe money

It’s important to understand that money isn’t what makes you feel rich. Money can provide a lot of resources and comfort that makes you happy, but it’s the freedom that comes from having money that really enables you to pursue your “best life”. Financial freedom gives you more choices to live your life. It gives you more time to spend with loved ones, work on passion projects, retire early, volunteer and give back to our industry.

“Success is doing what you want to do, when you want, where you want, with whom you want as much as you want” -Tony Robbins

Your journey to financial wellness is unique to you. It doesn’t matter where you are in this journey, as long as you take that first step.

Prioritizing your financial health is important because it helps you live a happy, content and fulfilled life. As mentioned earlier, money is a significant source of stress. We believe that focusing on actions that are within your control will not only improve your financial situation, but also your overall health!

InvestHealth is where healthcare professionals come to invest and innovate, care and collaborate.

Our mission is to give every healthcare professional the network and knowledge they need to take ownership of their financial future.

We will accomplish the mission by building products and partnerships that empower healthcare professionals to achieve financial success!

Reach out to us today on how we can help you reach your financial goals!